Wonderful Tips About How To Apply For Shared Equity

The process for applying for a shared equity place will be set out on the approved lending partner’s website before the scheme is planned to commence in january 2023.

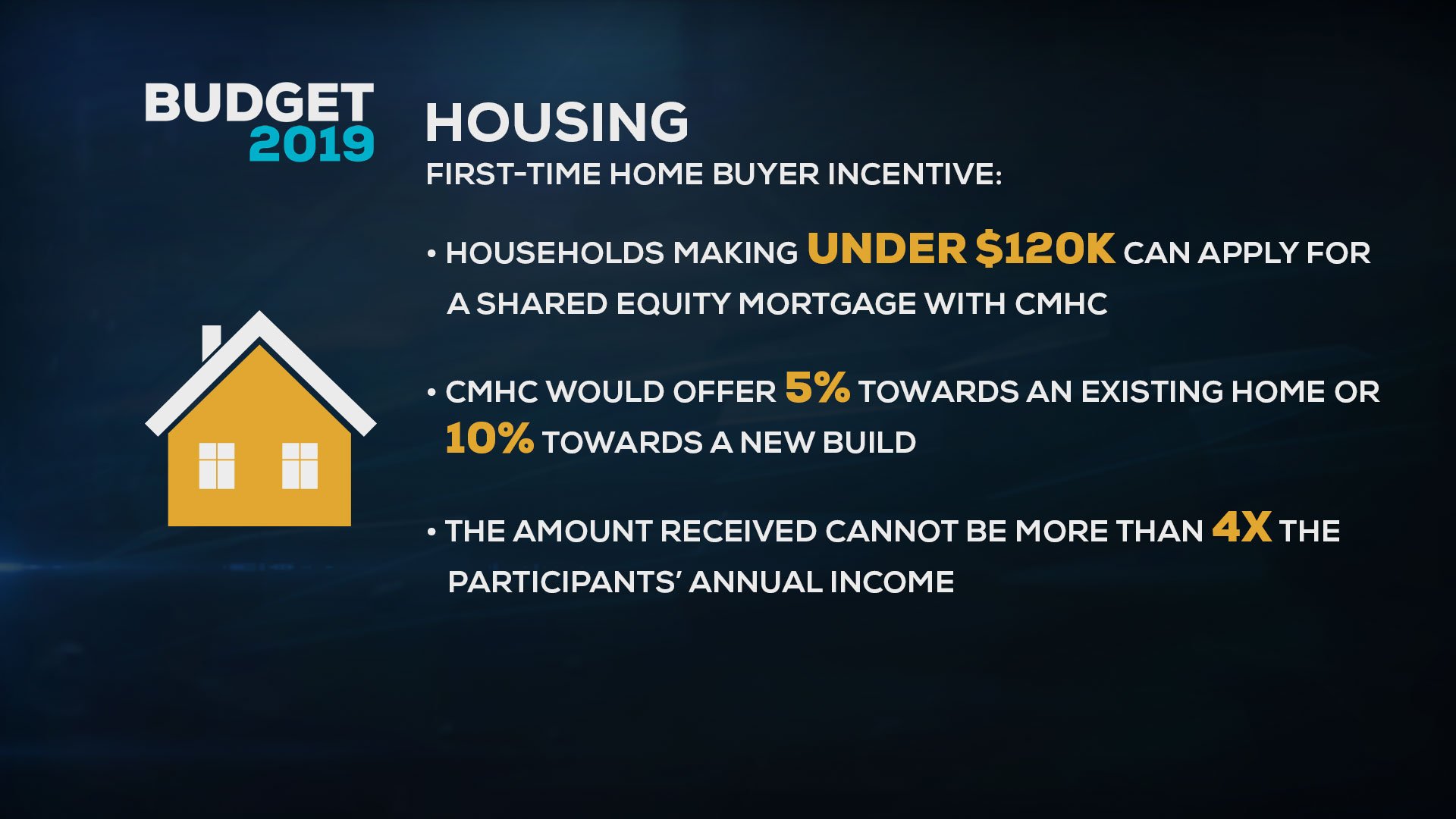

How to apply for shared equity. When applying for a shared equity mortgage loan, you should expect to provide a combination of the following: Applicants will need to earn under $90,000 per year for individuals, or less than. Pay a minimum deposit of 5% of the property purchase price.

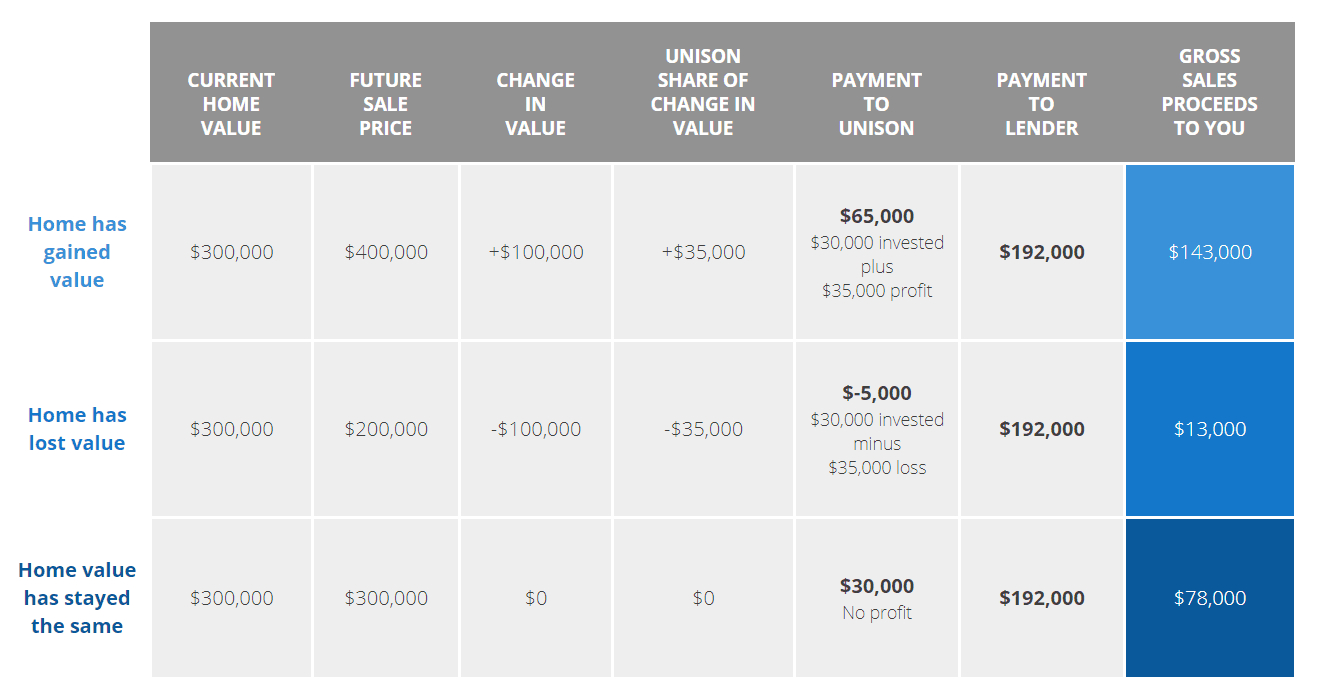

Let's say you buy a $700,000 house with $100,000 of your own money and frontya matches you. You can take out a mortgage to buy your share or pay for it with savings. If you want to buy a home with the help of a shared equity scheme, you’ll need to find your local help to buy agent.

Find a project in your area. Access funds now & in the future. To apply for this scheme you’ll need to meet the following criteria:

1.) submit a complete application for the shared equity program and meet the income and asset eligibility requirements. However, a service charge will apply to the equity stake from year 6 onwards and will apply. Arrange a repayment mortgage of at least 25% of the property purchase price.

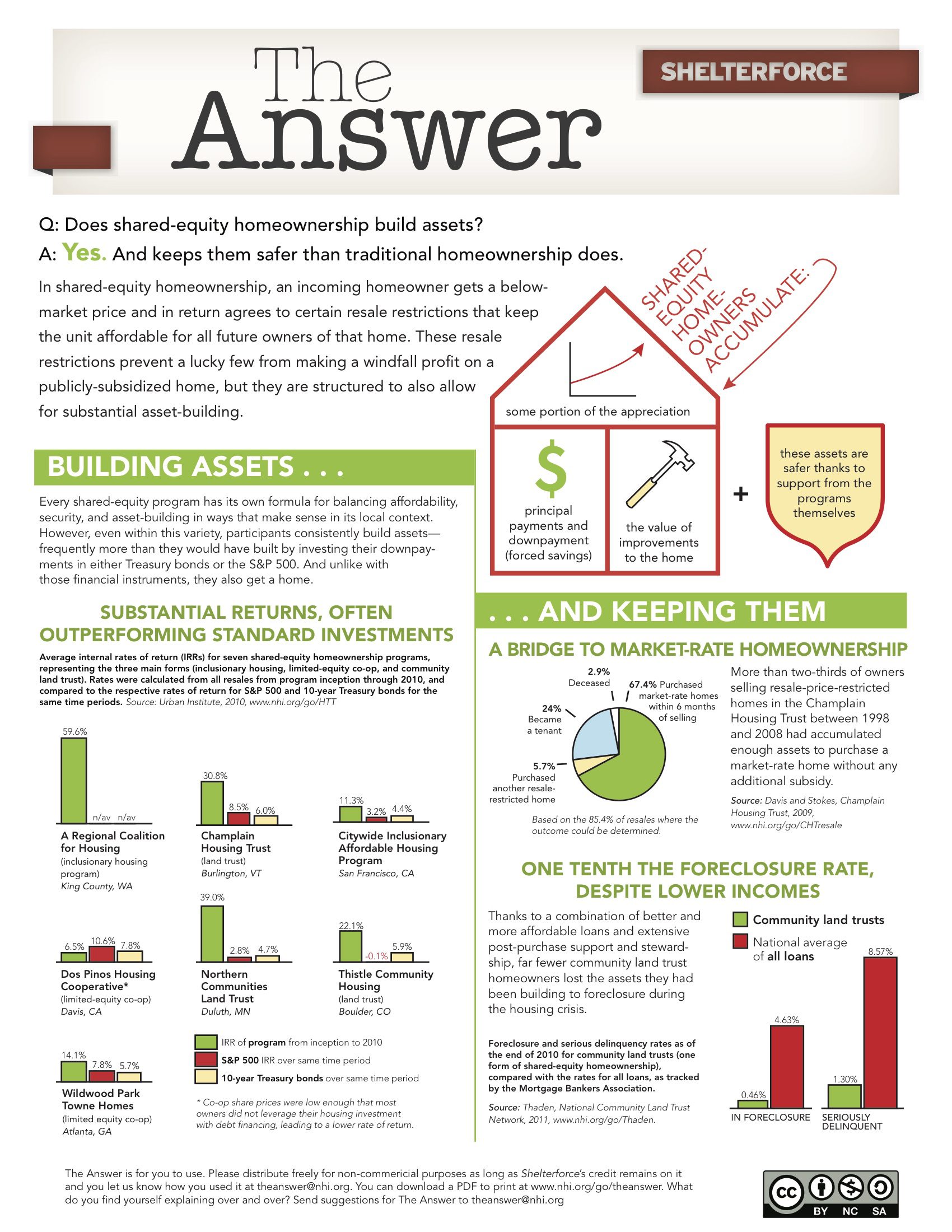

This means the investor will pay the homeowner a. Attend the shared equity program informational meeting (dates listed below) contact us for more information: How does the shared equity program work?

Submit a complete application for the shared equity program and meet the income and asset eligibility requirements. 5 years later you sell the property for $825,000. Frontya gets $100,000 from the.